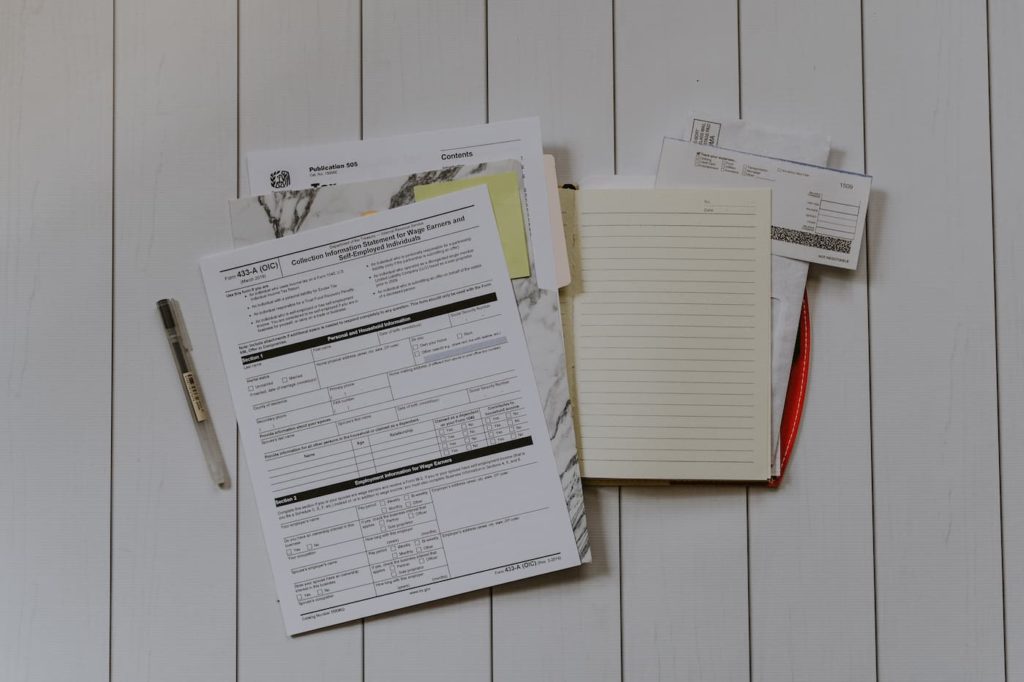

With April 15th drawing ever closer, tax prep season is in full swing. If you’re a rental property owner, tax season can be frustrating and challenging. That’s because it’s hard for the average person to keep track of all potential tax deductions and then document them in case of an audit. A great tax accountant can help, but every filer is responsible for providing their accountant with accurate information while maintaining proper documentation. With that in mind, here are the most common tax deductions investment owners can take:

Common Tax Deductions

The IRS includes rental income as part of your total taxable income. They do, however, allow rental owners to deduct certain expenses from their rental income. These deductions could include mortgage interest, property taxes, insurance, operating expenses, depreciation, and repairs.

Interest Payments

Most investment owners finance the purchase of their rental properties. These loans come with a cost, though, which is the mortgage interest borrowers pay each month. Because mortgage interest is a cost of doing business, the IRS allows owners to deduct this expense from their rental income. Interest payments add up quickly over the course of a year, so mortgage interest payments are often an investment owner’s most significant deduction. Most financial institutes make this information easy to find by mailing out 1098 tax statements at the end of the year or by making the forms available for download on their website.

If you applied for a new loan this year or refinanced an existing one, the origination fees and points you paid may also be deductible. Also, the IRS allows investment owners to deduct credit card interest paid on items used for the rental property. However, these expenses could be tough to document, especially if you used a personal credit card to make those purchases.

Property Tax Deductions

Local governments levy property taxes to pay for things like school districts, public safety, libraries, and road construction. These tax rates vary depending on your home’s location. Because these taxes are tied to your rental property, the IRS considers them fair game for a deduction. Your escrow summary should clearly list these expenses.

Operating Expenses

This is a catch-all category that covers the normal expenses associated with running your rental property. If you manage your rentals from an office space you pay for, those costs could be deducted. So could advertising costs, office supplies, mileage traveling between rentals, legal and professional fees, and more. It would be wise to consult the advice of a qualified tax accountant to determine precisely which operating expenses are deductible.

Depreciation

Business assets lose value over time. That’s why the IRS allows business entities to deduct the cost of depreciation from their income. Depreciation usually covers three categories:

- The value of your investment structure (not the land).

- The value of improvements, like carpet, windows, countertops, and roofs.

- Equipment like computers or laptops.

The IRS requires you to spread depreciation costs over several years. So, you should check with a tax pro to make sure you’re applying this deduction correctly.

Repairs

While your depreciation deduction covers the cost of improvements, rental owners can also deduct the cost of repairs. The IRS defines repairs as any effort that maintains the property’s current condition but does not add value. Typically, these would include:

- Painting.

- Plumbing repairs.

- HVAC repairs.

- Labor costs.

- Equipment rental fees.

Other Potential Tax Deductions

In addition to these five common deductions, investment owners may also be able to deduct these additional costs:

Insurance

Most lenders require borrowers to obtain homeowner’s insurance that protects the property against losses. Fortunately, those expenses are tax-deductible, as are other insurance costs like flood, earthquake, or liability coverage. If you have employees, you can also deduct the cost of their worker’s compensation and health insurance.

Utilities

If you pay your tenant’s utilities as part of the lease agreement, the IRS allows you to deduct those costs from your taxes. These could include electricity, gas, heating oil, water and sewer, or trash and recycling. If you pay for internet or cable or satellite services as well, you can also deduct those costs.

Maintenance

Maintenance costs are often confused with repair costs. However, they cover different needs. While repairs fix broken things, maintenance covers ongoing upkeep of the property. These costs could include items like:

- Landscaping.

- Homeowner Association Fees.

- Pest Control.

- Light Bulbs.

- Smoke Detector Batteries.

- HVAC Filters.

Again, a good tax accountant can guide you on how to classify these expenses, as well as the proper way to document them.

Management Fees

If running your rental property is just too big a hassle, you might pay a third-party to handle those tasks for you. It could be an employee you pay as a property manager, or, you might contract with a dedicated property management company. Either way, those costs are tax-deductible.

We Make Tax Deductions Easier

The benefits of working with a qualified property management company — like Rent Portland Homes by Darla Andrew — really shine through during tax season. At the beginning of each year, we issue all our property owners a 1099 statement, which lists their rental income for the previous year. We also upload copies of all repair and maintenance work orders and receipts for every property to our online management software. That means you can find all relevant information in one handy place. Documentation and information management has never been more straightforward.

Because we’re a full-service property manager, we help with every aspect of your rental. From tenant screening to lease agreements to maintenance repair and more, our team handles the details, so you don’t have to. What’s more, our valuable services are tax-deductible. That’s a significant added value. To learn more, contact us today at (503) 515-3170 or by filling out the contact form on our website.